AI-Powered investment research Tool

AI That Thinks Like Your Best Analyst

Make smarter investment decisions with sharper insights—delivered with speed, clarity, and confidence.

✓

Equity

Research

✓

Risk

Insights

✓

Due

Diligence

✓

Market

Monitoring

Your data all in one place

Say goodbye to stitching together data sources and jumping between platforms. Strēm connects directly to both structured and unstructured data sources so you can analyze and synthesize data and commentary in minutes.

✓ Ingests SEC filings, earnings transcripts, fundamentals,

sentiment, and internal notes

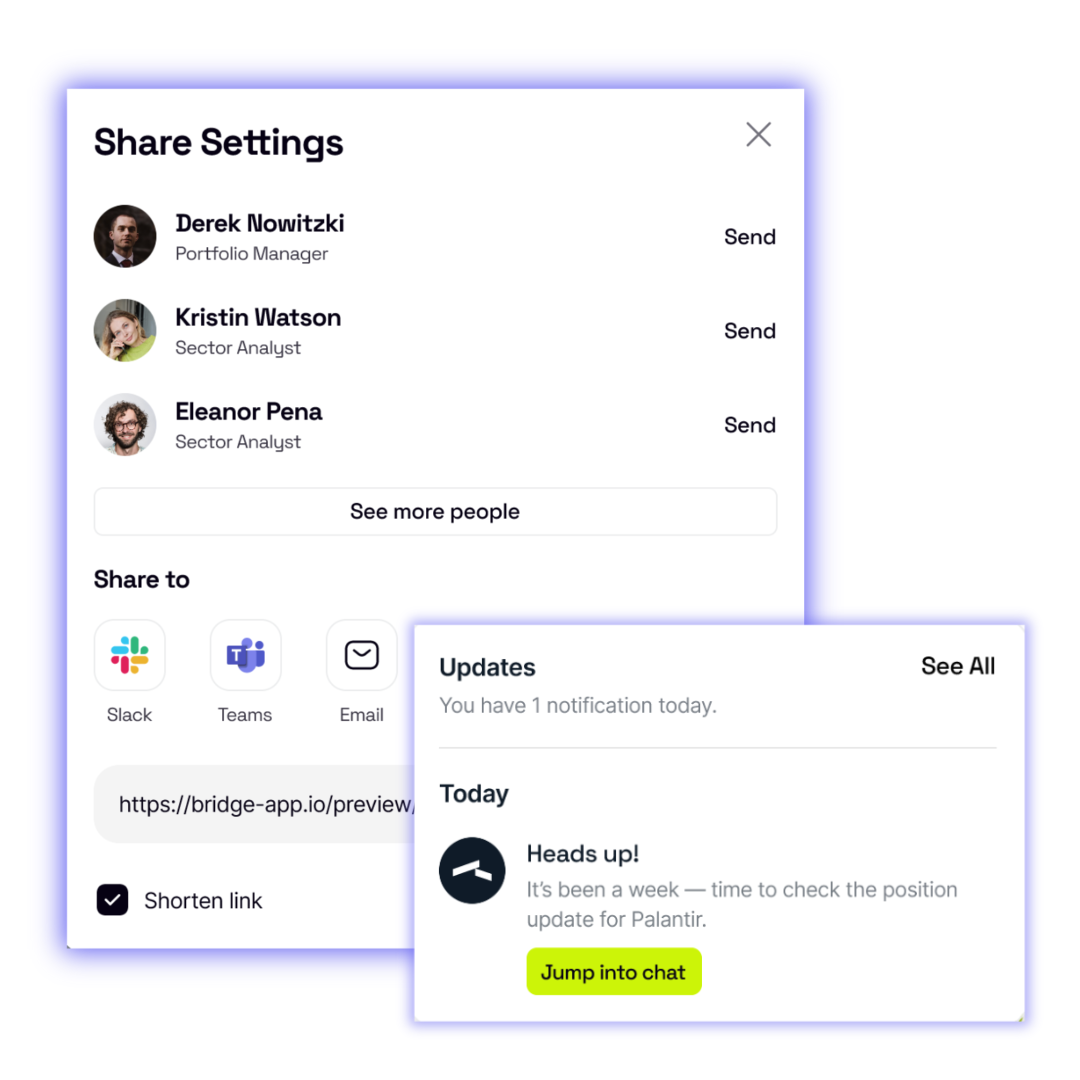

Built to fit your team’s Workflow

Power the full research lifecycle within a single, connected system reducing unnecessary friction between analysis and action.

✓ Share key findings within the tools teams already use like Slack, Teams, and email

✓ System notifications that monitor investment positions

Portfolio-aware intelligence that surfaces your next trade idea

Strēm connects analysis directly to your portfolio and pipeline, highlighting signals on both active exposures and names on your radar. Every output is designed to help you:

✓ Spot alpha-driving signals sooner

✓ Reduce risk with clear reasoning trails, source citations, and confidence scores

✓ Make high-conviction decisions faster

The thought partner you didn’t know you needed

Powering the full investment lifecycle

Uncover Hidden Insights

Strēm analyzes a broad universe of companies, identifying opportunities that traditional methods take weeks to spot.

Spot Emerging Trends

Strēm helps you detect emerging trends and high-growth potential in mid and small-cap markets, where alpha is often hidden.

Enhance

Performance

By identifying high-potential investments earlier, Strēm gives you the tools to drive better long-term returns and mitigate risks.

Expand Coverage with Ease

Adding the equivalent of 9-25 analysts to your team (without the additional overhead) ensuring you capture every opportunity.